The Blog

Let’s talk about write-offs!

WHAT ARE THEY? AND HOW CAN WE GET MORE OF THEM?

HERE IS A VERY SIMPLIFIED EXAMPLE:

Someone pays you for graphic design work : $1,000

Adobe Creative Cloud monthly charge : -$54

Notebook for sketches : -$10

Creative market charge : -$20

Total: $916

THAT MEANS you aren’t paying income tax on $1,000 – you’re paying it on $916. See what I mean? The more legitimate expenses you have, the more your income is lowered – MEANING YOU PAY LESS TAXES

HERE’S WHY YOU SHOULD CARE

THREE THINGS YOU NEED TO DO RIGHT NOW (if you haven’t already)

1. Get Quickbooks Simple Start (this is always going to be my number #1 piece of advice every time), so that you can organize all your tax deductible expenses. At the end of the year, give a P&L and a Balance Sheet (which you create in Quickbooks) to your CPA, and they will go through your business expenses and determine what is tax deductible (lowers your income) and how much.

THIS IS HOW YOU “WRITE IT OFF”

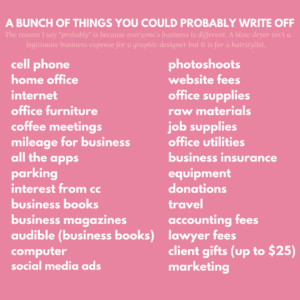

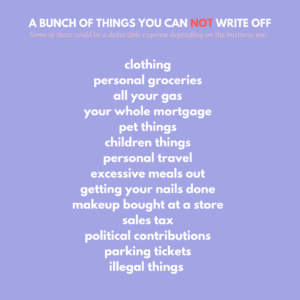

See below for some helpful examples:

Comments will load here

Be the first to comment