The Blog

Business Expense on a Personal Card?

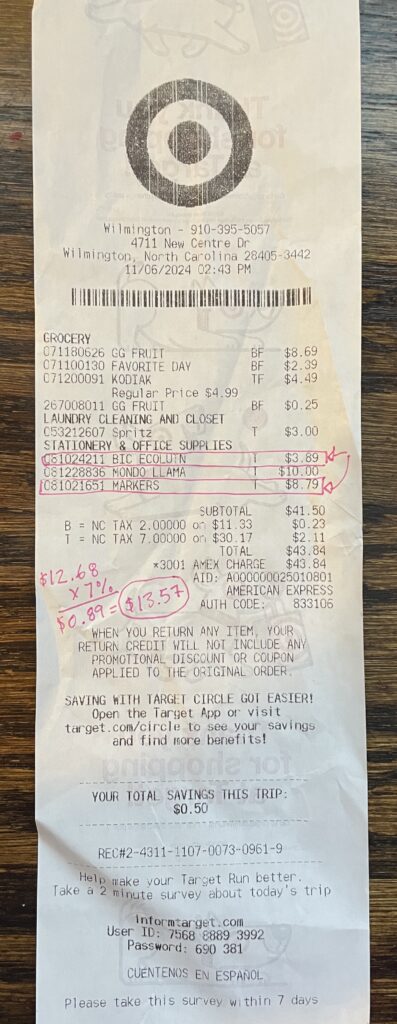

Have you ever been shopping at Target with your two year old and bought personal items AND business items ON YOUR PERSONAL CARD? I have. I didn’t have time to switch cards and wrangle a toddler, but I would like my $13.57 tax deduciotns (thank you very much) for the office supplies I bought and I know you do to.

First – get your receipt – highlight the business expenses AND add any tax they added. (See below)

Your first option is to transfer $13.57 from your business into your personal account and call it “office supplies”

Your second option (the one I like more) is to make a journey entry in Quickbooks so you don’t have to actually move any real money and still get the tax deduction.

WARNING – journal entries are like over riding whole system – so make sure you are doing them correctly.

(See video below for step by step)

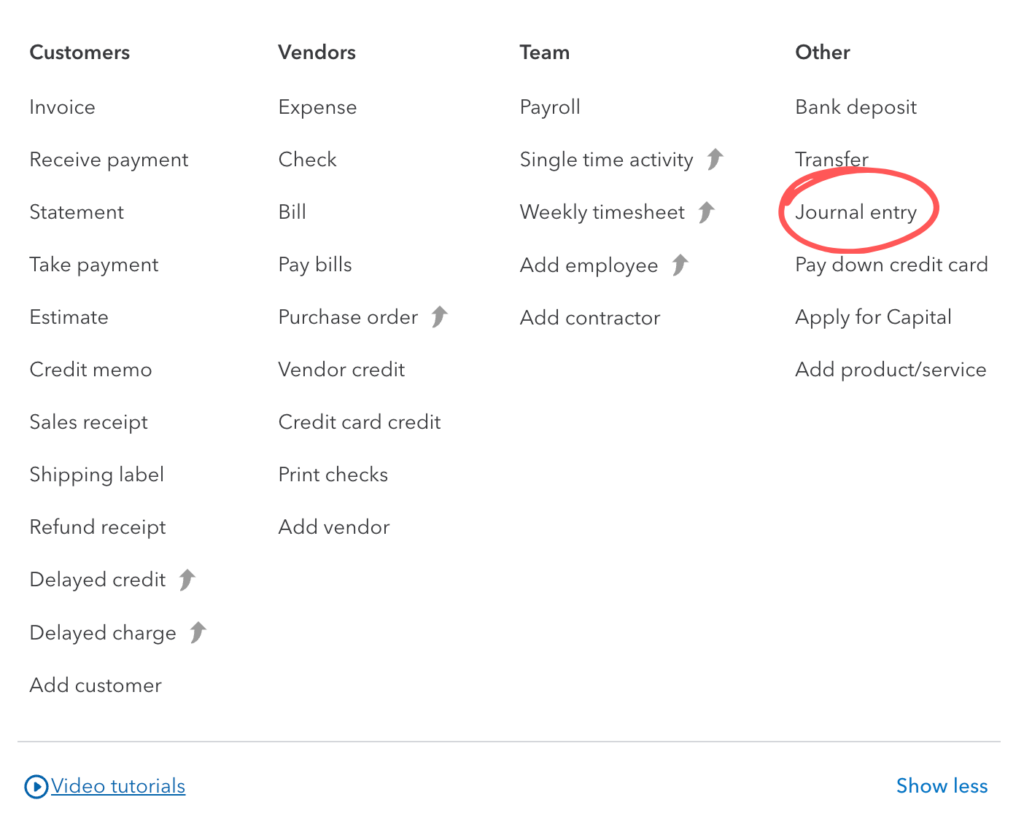

To make a journal entry in Quickbooks, you’ll want to go to the left hand corner and select the “+ New” button.

Then under “Other” select “Journal entry”

This will open up a new journal entry (JE).

- Date it the date of the purchase

- Name the (JE)

- Line one will be “Owner’s Contribution ” and then in the credits box type the amount of your business purchase. Write what happened and what it was for.

- Line two will be “Office supplies” in this example, but it could be whatever category fits your purchase, like “meals” or “furniture” or “apps” and then Quickbooks should fill in the debit box for the same amount.

Make sure to attached your receipt to the bottom of the JE.

This is a great way to make sure you get the deduciotns, but not have to move any cash. If you need more help, book a call HERE!

HOW TO VIDEO BELOW!

Comments will load here

Be the first to comment