The Blog

BIZ HACKS

MMTAM

MONEY MOVES

I am the brain behind the books. I am an atypical mishmash of the left brain/right brain.

Hi, I'm Alisha

Who you calling a 1099?

Who’s a 1099? Am I a 1099? (maybe?) What is a 1099?

Contract labor is an area that is often fuzzy for creatives. Let’s start with the basics:

If you pay someone to do something for your business who isn’t your employee and is not a corporation you could have a 1099 situation on your hands – also called contract labor or independent contractor.

That’s why you should make everyone you pay fill out a W9. (you can download one here). Why, you ask? Because the government wants to tax that person’s income. Often that’s why people try to avoid filling out W9s because they don’t want to be 1099-ed. Since they aren’t an employee, you are not withholding taxes.

Uncle Sam wants. that. cash.

so Let’s Break It Down

- A W9 is the form you make a contractor fill out (You will gather their name (or business name), address, tax classification (like are they an S-corp or just a single individual), their Social Security number or tax ID, and they MUST sign and date it.

- A 1099-NEC is the form you MUST fill out at the end of the year. It will have all the information you have collected from contractors on the W9 along with how much you ended up paying them. Once that is done you (or I) will file it with the Federal Government.

- The silver lining is that it’s only for contractors you paid over $600 in rents, services (including parts and materials), prizes and awards or other income payments throughout the course of the year – that was not from a 3rd-party payment processor.

There are a lot of other things you need to know – like, you must treat them as an independent laborer and not an employee. This means they have to use their own tools, you have less control over them, and you must work within the terms.

BEST PRACTICE – Make EVERYONE you pay money fill out a W9 BEFORE you pay them. I said, BEFORE YOU PAY THEM!

I hear clients say to me, “Oh, well I’m only paying them $100 for writing copy that one time.” Then they love that copywriter and use them 8 more times…now, guess what? You need to 1099 them and you didn’t get them to fill out a W9 before you paid them. You don’t have their social or EIN number. And now you know what happens? You call to get the W9 and they never fill it out – why? because they don’t want to pay the taxes on the money you paid them OR even better – they didn’t know you were going to 1099 them and now they are sad.

One more time for the people in the back. MAKE EVERYONE YOU PAY MONEY FILL OUT A W9 BEFORE YOU PAY THEM.

I know this is all annoying, and you’re probably like,“wait……what?” But that’s what I’m here for! I could do it for you. I could do it for you. Yep. You tell me that you have hired “Jennifer” to write copy for you… I will HUNT her down (nicely…but effectively) and make her fill out that W9 BEFORE you pay her. Even better than that, I will fill your 1099s at the end of the year for you.

Yeah, I would do that for you. So you can get back to making your pretty things.

TAX LAWS SUBJECT TO CHANGE.

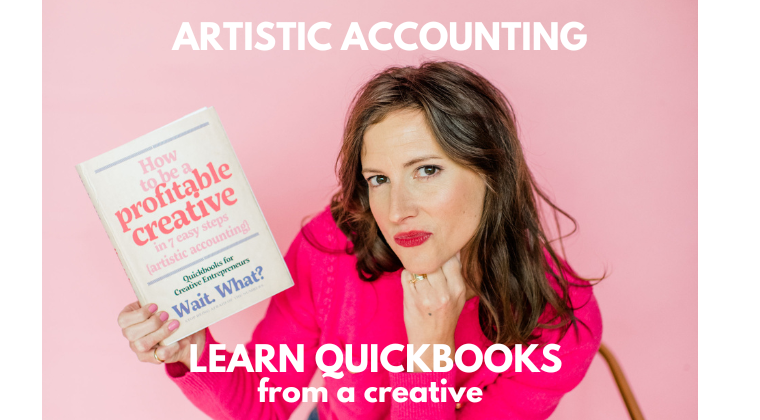

Need help pulling it all together? Check out our Quickbooks course, Artistic Accounting

Your Comment Form loads here

Comments will load here

Be the first to comment